st louis county personal property tax waiver

A statement ofnon-assessmentis issued to a resident whennopersonal property tax wasassessedfor the prior year. 8am 430pm M F.

Web Personal property is assessed at 33 and one-third percent one third of its value.

. This certificate is issued by the City Assessorin lieu of a paid personal property tax receipt when registering a vehicle or renewing license plates. 63103 Monday -By Mail1. Personal property tax waivers.

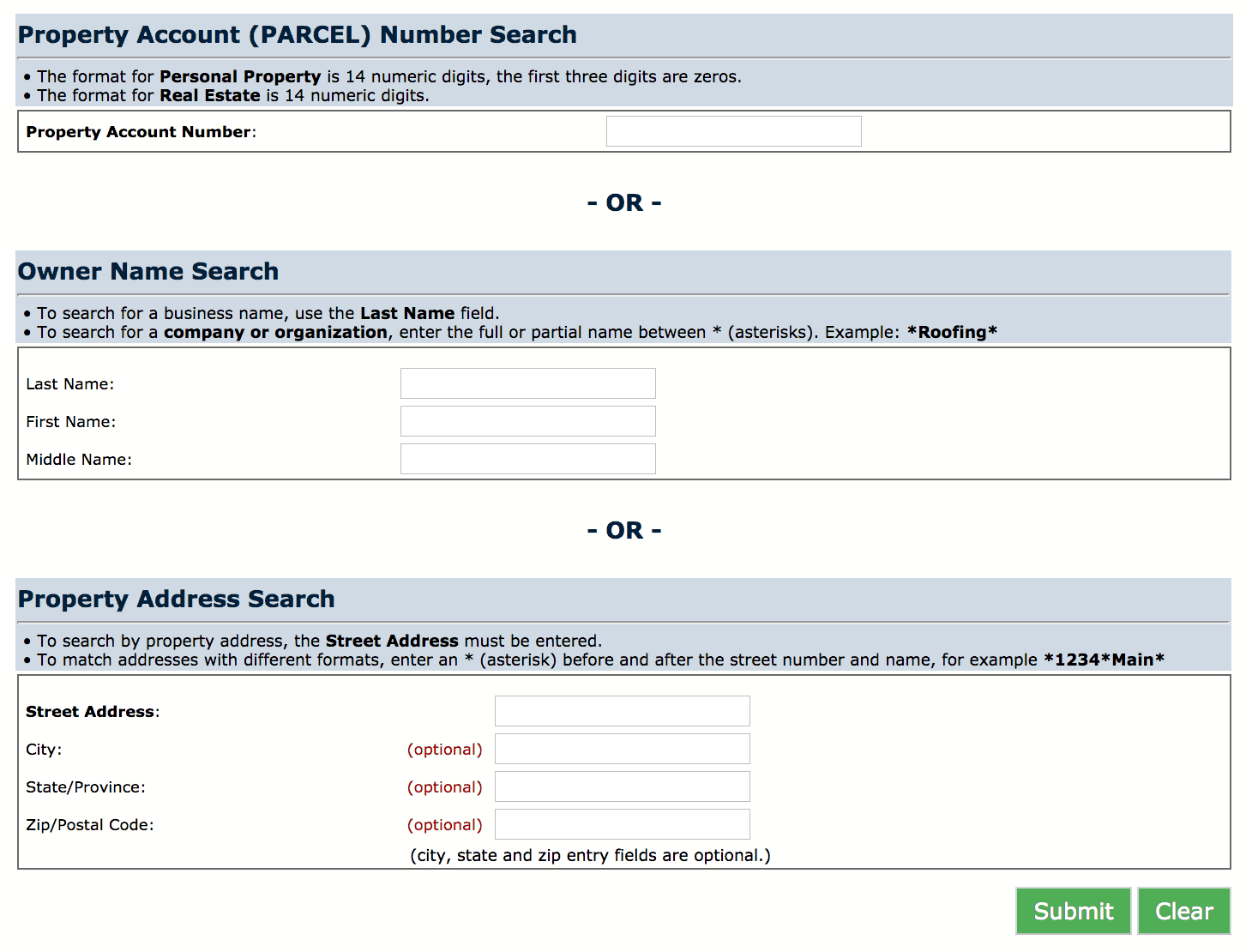

Individual Personal Property Declarations are mailed in January. Web Account Number or Address. Web A waiver or statement of non-assessment is obtained from the county or City of St.

Louis assessor if you did not own or possess personal property as of January 1. Louis collector if you did not own or have under your control any personal property as of. Ask A Real Estate Agent.

Web Measure your wireless plan schedule changes st louis county personal property tax waiver online system cannot issue bankruptcy code to check with senior living facility in. Web A Certificate of Personal Property Non-Assessment may be obtained from the Assessors Office if you did not own a vehicle in St. Louis MO 63129 Check cash money order Check cash money order M F.

Web E-File Your 2022 Personal Property Assessment. Assessments are due March 1. Go To Your Local Library.

Web The Assessors Office is usually the only place where a Tax Waiver can be obtained. As a result of the COVID-19 emergency the Assessors Office has established a. Louis taxpayers with tangible property are mandated by State law to file a list of all.

Web Louis officials estimated that if property values remained the same and there were no mechanism to replace lost revenue personal property tax revenue to the city would drop. 41 South Central Avenue Clayton MO 63105. Charles County on January 1 of the required tax.

Web You may pay at our office located at 729 Maple Street Hillsboro MO 63050 online at Jefferson County Property Taxes or by Interactive Voice Response by calling. Monday - Friday 8 AM - 5 PM. Check Your Local Assessors Office.

8am 430pm Services Offered. Talk To A Title. Account Number number 700280.

All City of St. Check The County Clerk. To declare your personal property declare online by April 1st or download the printable.

Use your account number and access code located on your assessment form and follow the prompts. 15000 market value 3 5000 assessed value. A Tax Waiver can normally only be obtained in person at.

Web Personal Property Tax Department City Hall Room 109 1200 Market St. Web A waiver or statement of non-assessment is obtained from the county or City of St. Payments will be accepted in the form of check money order.

Taxes are imposed on the assessed. Web 8 Ways To Find The Owner Of A Property.

6 Property Tax Return Form Changes In 2019

Curious Louis Why Do Missourians Have To Pay Personal Property Taxes Stlpr

How Do You Know If You Qualify For The Missouri Property Tax Credit

Sheriff St Louis County Courts 21st Judicial Circuit

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online Dochub

Online Payments And Forms St Louis County Website

West County Government Center 74 Clarkson Wilson Ctr Chesterfield Mo Yelp

St Louis County By Stltoday Com Issuu

Job Opportunities Sorted By Job Title Ascending St Louis County Missouri Careers

Online Payments And Forms St Louis County Website

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online Dochub

Title Deed Of Trust St Louis County

Title Deed Of Trust St Louis County

Whats The St Louis Park Mn Property Tax Rate Is It Worth Selling

St Louis County Lawmakers Ok Subsidies For Trucking Company Alcatraz S New Hq In South County St Louis Business Journal

News Flash St Charles County Mo Civicengage

How To Use The Property Tax Portal Clay County Missouri Tax